Paying your Property Taxes

** Paying by credit card? All credit card transactions with the City are subject to a non-refundable 3.5% processing fee to cover the fees credit card companies charge the City. **

My City Hall

In person at City Hall

We accept Interac or cheques, please bring your tax notice and payment to:

Finance Department

10631 100 Street

Fort St. John, BC V1J 3Z5

Our hours are 8:30 a.m. to 4:30 p.m. Monday to Friday. We are closed on statutory holidays.

By mail

Mail your cheque along with the bottom portion of your tax notice to:

City of Fort St. John Property Tax

10631 100 Street

Fort St. John, BC V1J 3Z5

Cheque Details

- Include your roll number on the cheque

- Make payable to the City of Fort St. John

- We accept postdated cheques

Payments must be received at City Hall on or before the due date printed on the front of the notice. POSTMARKS ARE NOT ACCEPTED AS PROOF OF PAYMENT. Please see the back of your tax notice for additional details.

Dishonoured cheques constitute non-payment and will be subject to penalty, interest, and a $30 service charge.

Online Banking

- Log onto online banking with your financial institution

- If you do not have online banking, contact your bank to set it up.

- Add the City of Fort St. John as a payee, search the word “Fort” in the payee field and look for Fort St John City Taxes or Fort St John City Property Taxes.

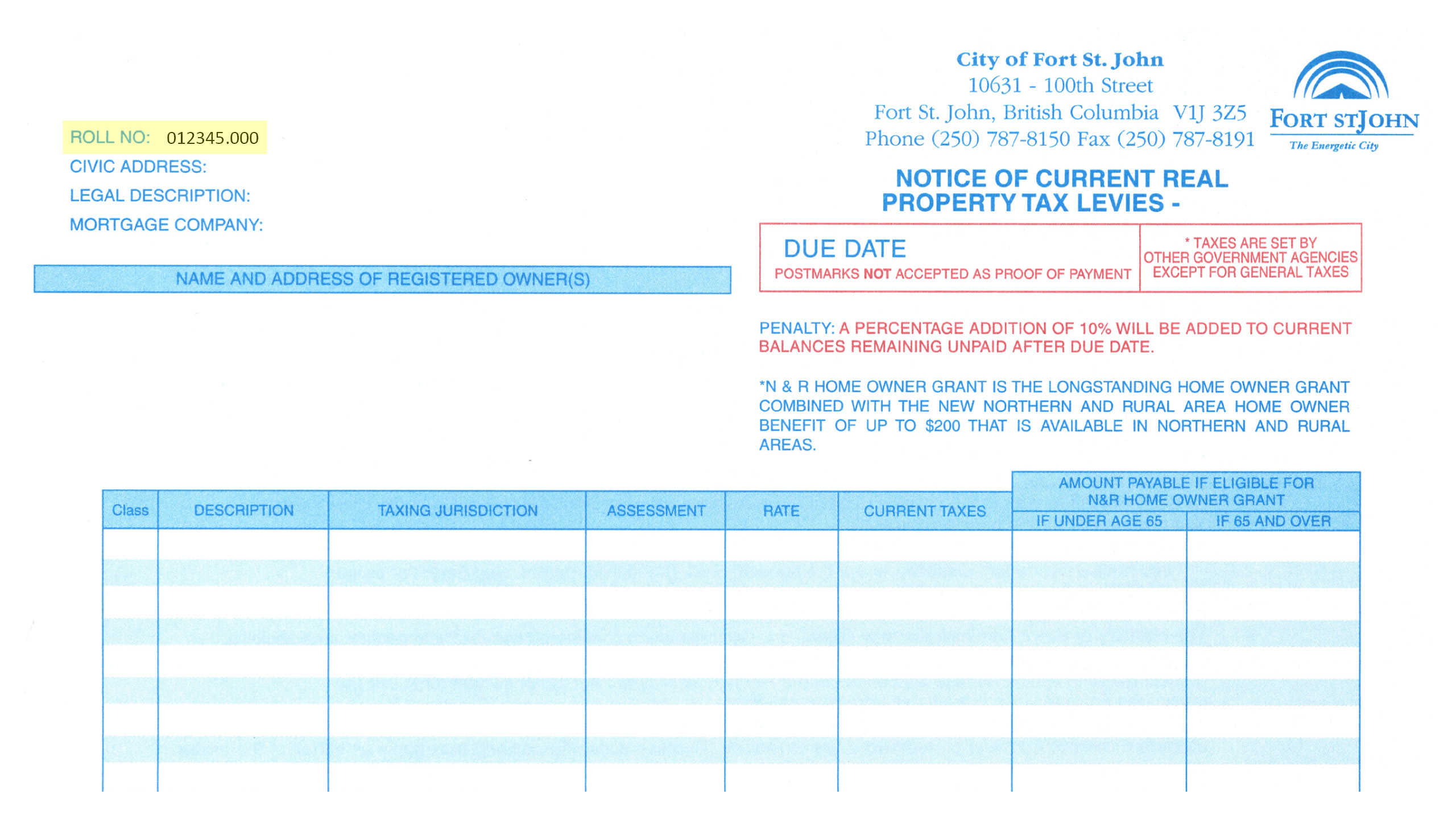

- Once you have located us in the list, add the ROLL NO: located at the top of your tax notice, into the account number field. Enter all the digits except for the period, so 012345.000 would be entered as 012345000.

- If you have more than one property, you will need to setup an account for each property.